Market Watch

The Semiconductor Signal: Why Taiwan’s Export Cycle Leads Global Equity Markets

Can a single economy of just 23 million people offer a reliable signal for the direction of global equity markets?

History suggests it can.

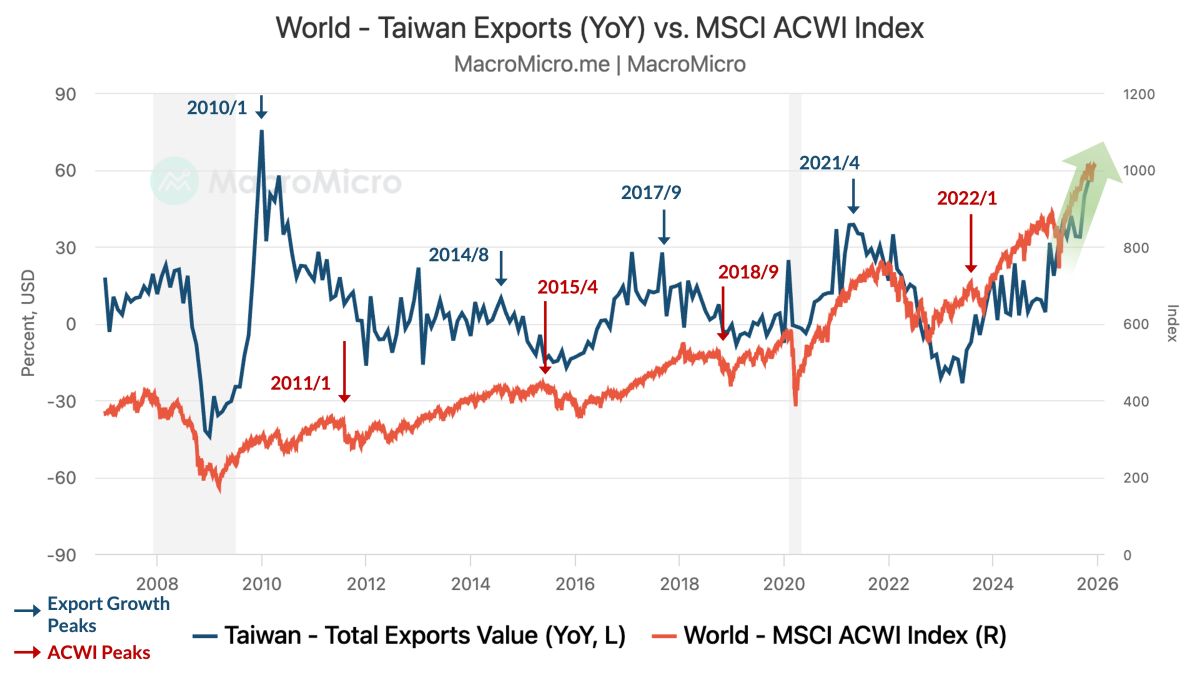

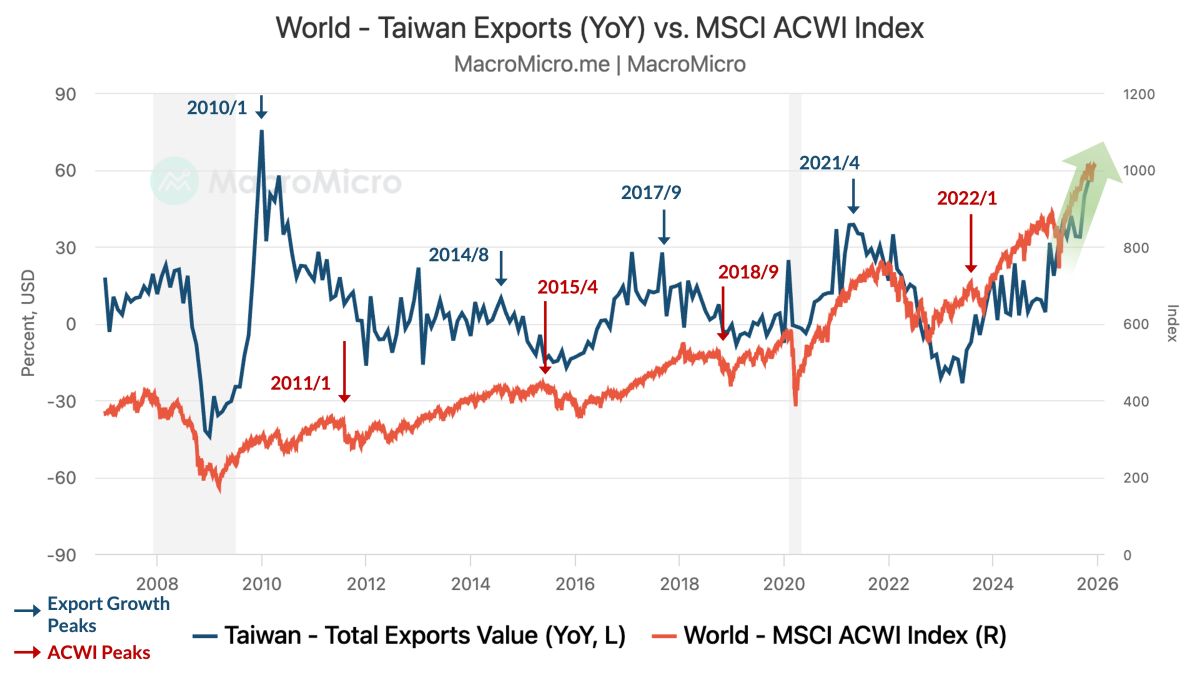

Over multiple market cycles, Taiwan’s semiconductor-driven export growth has acted as a consistent leading indicator for global equities, anticipating turning points in the MSCI ACWI Index by approximately 8 to 12 months. As we approach the end of 2025, that signal is once again flashing - and for sophisticated allocators, it deserves close attention.

Source: MacroMicro Research

Export growth peaked in early 2017, preceding the global equity cycle’s inflection later that year. A similar sequence unfolded in 2021, when Taiwan’s export surge anticipated the subsequent advance in global equities. More recently, exports bottomed in late 2023 after a prolonged semiconductor downturn and turned decisively positive in September of that year - once again ahead of the continued strength in global equities through 2024 and into 2025.

The pattern is clear: inflection points in Taiwan’s export growth consistently occur before peaks and troughs in global equity markets, reinforcing the idea that this is a structural leading indicator rather than a coincidental correlation.

Before revenue is recognised by global technology leaders, before capital expenditure is discussed on earnings calls, and before equity markets reprice future growth, orders for advanced semiconductors must be placed. Those orders flow first to Taiwan.

Taiwan is home to the world’s most critical semiconductor manufacturing ecosystem, anchored by TSMC, which produces the vast majority of the world’s most advanced logic chips. These chips underpin AI data centres, cloud infrastructure, and next-generation computing platforms used by companies such as Nvidia, Microsoft, and Amazon.

As a result, Taiwan’s export data functions as a near real-time proxy for global capital expenditure intentions. When global demand improves, manufacturers restock and place orders upstream. When confidence weakens, those orders are cut rapidly to avoid inventory accumulation. Taiwan captures both dynamics earlier than downstream economies.

The global AI investment wave has sharply increased the strategic importance of advanced semiconductors. Unlike many past technology cycles, AI infrastructure demand is both capital-intensive and difficult to substitute. Hyperscalers cannot execute their roadmaps without access to leading-edge chips, making near-term demand relatively inelastic.

This dynamic has been directly reflected in Taiwan’s export figures. November exports reached a record USD 64 billion, up 56% year-on-year, marking the fastest pace of growth in more than 15 years. Information and communication technology exports surged, driven by AI processors, memory chips, and related hardware. Shipments to the United States rose sharply, reflecting sustained AI infrastructure build-outs by the world’s largest technology firms.

Crucially, this surge is occurring upstream, before it is fully visible in global earnings or macroeconomic statistics. The equity market strength observed through 2024 and 2025 was anticipated by this export acceleration with the usual 8–12 month lag.

When business conditions improve, companies commit capital and place orders for semiconductors. Taiwan’s exports rise immediately, capturing that commitment at the earliest stage. Over time, those semiconductor orders translate into production, revenue, and margins further down the value chain. Equity markets ultimately reprice as earnings visibility improves.

The process works symmetrically in downturns. When demand weakens, manufacturers cut orders early to prevent inventory build-ups. Taiwan’s exports decline first, often well before broader equity markets begin to reflect the slowdown.

In effect, Taiwan’s export cycle reflects the global economy’s “capex heartbeat” - a signal that markets typically recognise only with a delay.

That said, the signal warrants nuance. With monthly exports now consistently exceeding USD 60 billion, base effects become increasingly important. Sustaining exceptionally high growth rates from such an elevated level will require continued expansion in absolute demand. Even so, growth moderating to the mid-teens would remain consistent with a constructive backdrop for global equities, particularly technology-heavy indices.

The implication is that the next phase of the equity cycle may remain relatively concentrated, favouring markets and sectors most directly exposed to semiconductors, AI infrastructure, and digital capital expenditure, rather than a broad-based industrial upswing.

While no single indicator should be relied upon in isolation, the consistency of this signal across multiple cycles - and its amplification in the AI era - makes it particularly compelling today.

For global investors assessing the durability of the current equity cycle, Taiwan’s export strength suggests that the underlying engine of growth remains intact - and that markets may still be pricing yesterday’s conditions rather than tomorrow’s earnings.

History suggests it can.

Over multiple market cycles, Taiwan’s semiconductor-driven export growth has acted as a consistent leading indicator for global equities, anticipating turning points in the MSCI ACWI Index by approximately 8 to 12 months. As we approach the end of 2025, that signal is once again flashing - and for sophisticated allocators, it deserves close attention.

Source: MacroMicro Research

A Repeatable Leading Relationship

The relationship between Taiwan’s export cycle and global equity performance is not anecdotal; it has repeated with notable consistency across very different macro regimes.Export growth peaked in early 2017, preceding the global equity cycle’s inflection later that year. A similar sequence unfolded in 2021, when Taiwan’s export surge anticipated the subsequent advance in global equities. More recently, exports bottomed in late 2023 after a prolonged semiconductor downturn and turned decisively positive in September of that year - once again ahead of the continued strength in global equities through 2024 and into 2025.

The pattern is clear: inflection points in Taiwan’s export growth consistently occur before peaks and troughs in global equity markets, reinforcing the idea that this is a structural leading indicator rather than a coincidental correlation.

Why Taiwan Matters: The Upstream Position

The explanatory power of Taiwan’s exports lies in its position at the very beginning of the global technology supply chain.Before revenue is recognised by global technology leaders, before capital expenditure is discussed on earnings calls, and before equity markets reprice future growth, orders for advanced semiconductors must be placed. Those orders flow first to Taiwan.

Taiwan is home to the world’s most critical semiconductor manufacturing ecosystem, anchored by TSMC, which produces the vast majority of the world’s most advanced logic chips. These chips underpin AI data centres, cloud infrastructure, and next-generation computing platforms used by companies such as Nvidia, Microsoft, and Amazon.

As a result, Taiwan’s export data functions as a near real-time proxy for global capital expenditure intentions. When global demand improves, manufacturers restock and place orders upstream. When confidence weakens, those orders are cut rapidly to avoid inventory accumulation. Taiwan captures both dynamics earlier than downstream economies.

AI Has Amplified the Signal

In the current cycle, this leading relationship has become even more pronounced.The global AI investment wave has sharply increased the strategic importance of advanced semiconductors. Unlike many past technology cycles, AI infrastructure demand is both capital-intensive and difficult to substitute. Hyperscalers cannot execute their roadmaps without access to leading-edge chips, making near-term demand relatively inelastic.

This dynamic has been directly reflected in Taiwan’s export figures. November exports reached a record USD 64 billion, up 56% year-on-year, marking the fastest pace of growth in more than 15 years. Information and communication technology exports surged, driven by AI processors, memory chips, and related hardware. Shipments to the United States rose sharply, reflecting sustained AI infrastructure build-outs by the world’s largest technology firms.

Crucially, this surge is occurring upstream, before it is fully visible in global earnings or macroeconomic statistics. The equity market strength observed through 2024 and 2025 was anticipated by this export acceleration with the usual 8–12 month lag.

From Orders to Earnings: The Transmission Mechanism

The mechanism linking Taiwan’s exports to global equity performance is straightforward but powerful.When business conditions improve, companies commit capital and place orders for semiconductors. Taiwan’s exports rise immediately, capturing that commitment at the earliest stage. Over time, those semiconductor orders translate into production, revenue, and margins further down the value chain. Equity markets ultimately reprice as earnings visibility improves.

The process works symmetrically in downturns. When demand weakens, manufacturers cut orders early to prevent inventory build-ups. Taiwan’s exports decline first, often well before broader equity markets begin to reflect the slowdown.

In effect, Taiwan’s export cycle reflects the global economy’s “capex heartbeat” - a signal that markets typically recognise only with a delay.

What the Current Signal Is Telling Us

If the historical lag continues to hold, the strength in Taiwan’s exports through late 2025 suggests that global equities retain fundamental support well into 2026. The physical orders have already been placed; downstream revenue recognition generally follows.That said, the signal warrants nuance. With monthly exports now consistently exceeding USD 60 billion, base effects become increasingly important. Sustaining exceptionally high growth rates from such an elevated level will require continued expansion in absolute demand. Even so, growth moderating to the mid-teens would remain consistent with a constructive backdrop for global equities, particularly technology-heavy indices.

The implication is that the next phase of the equity cycle may remain relatively concentrated, favouring markets and sectors most directly exposed to semiconductors, AI infrastructure, and digital capital expenditure, rather than a broad-based industrial upswing.

Conclusion: A Signal Worth Respecting

Taiwan’s role in the global economy has transformed its export data into one of the most informative leading indicators available to investors. Positioned at the centre of global semiconductor manufacturing and AI-driven capital expenditure, the island’s trade cycle offers a rare window into future demand, corporate confidence, and earnings momentum.While no single indicator should be relied upon in isolation, the consistency of this signal across multiple cycles - and its amplification in the AI era - makes it particularly compelling today.

For global investors assessing the durability of the current equity cycle, Taiwan’s export strength suggests that the underlying engine of growth remains intact - and that markets may still be pricing yesterday’s conditions rather than tomorrow’s earnings.

|

Duarte Caldas

Investments Principal

|

With more than 20 years of experience in financial markets, Duarte specialized in the energy area in the last decade, where he had the opportunity to work with the main European Power and Gas institutions at CIMD Group. Previously, he worked as Market Strategist at IG Markets Iberia.