Market Watch

S&P 500 Outlook: Multiples Should Continue to Expand, Despite Current Levels

All in all, the US economy has gained momentum recently, despite the uncertainty triggered by the US Administration, remaining surprisingly resilient. Meanwhile, forward earnings continue to be reviewed upwards, partially explained by the mechanical effect, as the year goes on, forward growth, as usual, increases, ceteris paribus. Finally, valuations remain inappropriate for “Value Investors”, however assuming that over the coming weeks/months more Tariffs Agreements will be settled, the positive environment should remain in place and Multiples should continue to expand.

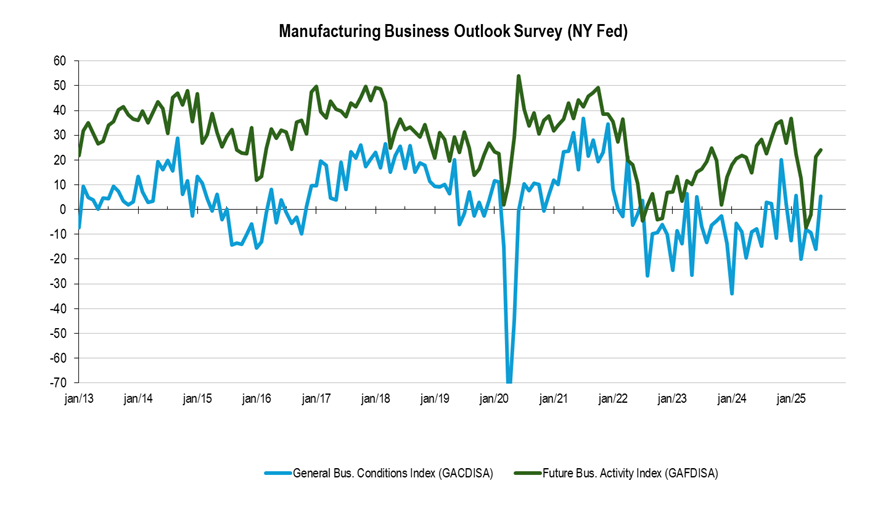

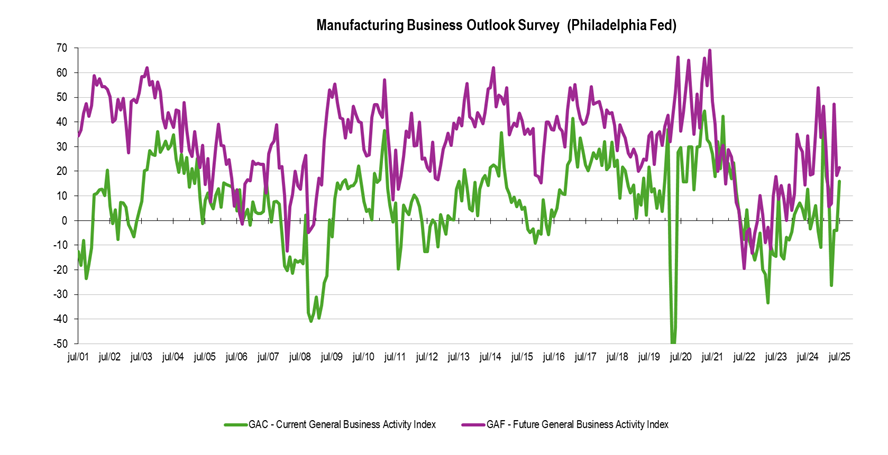

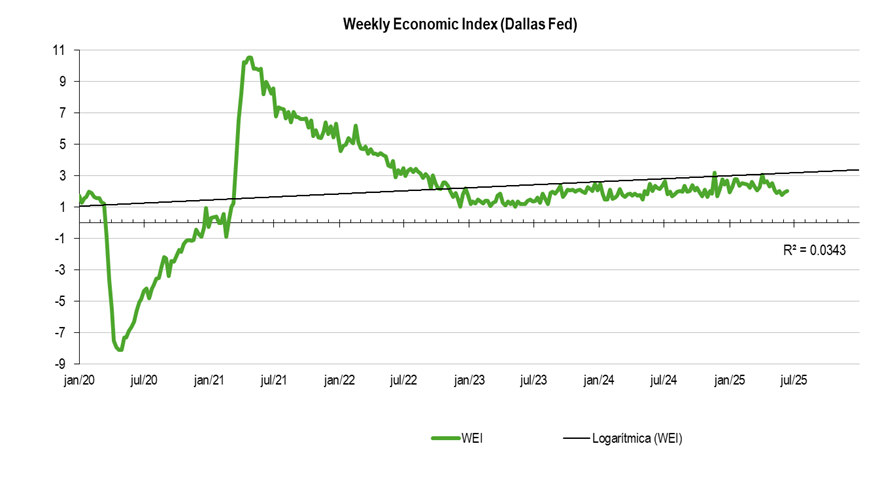

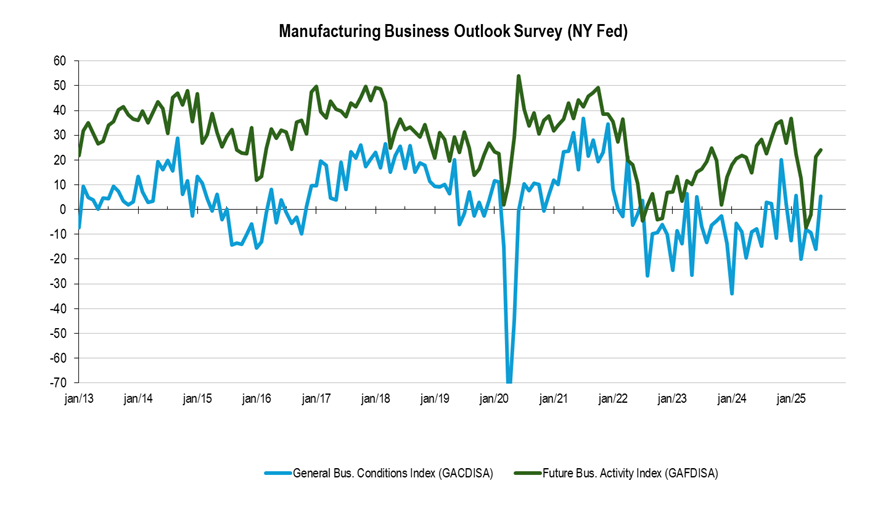

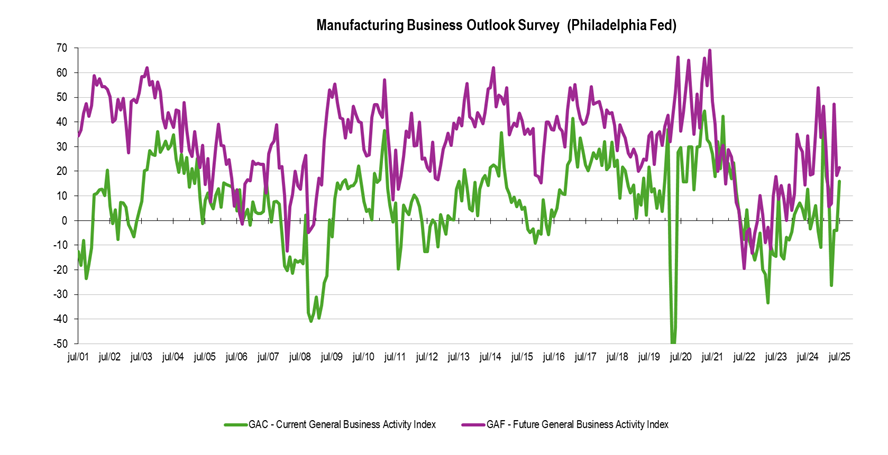

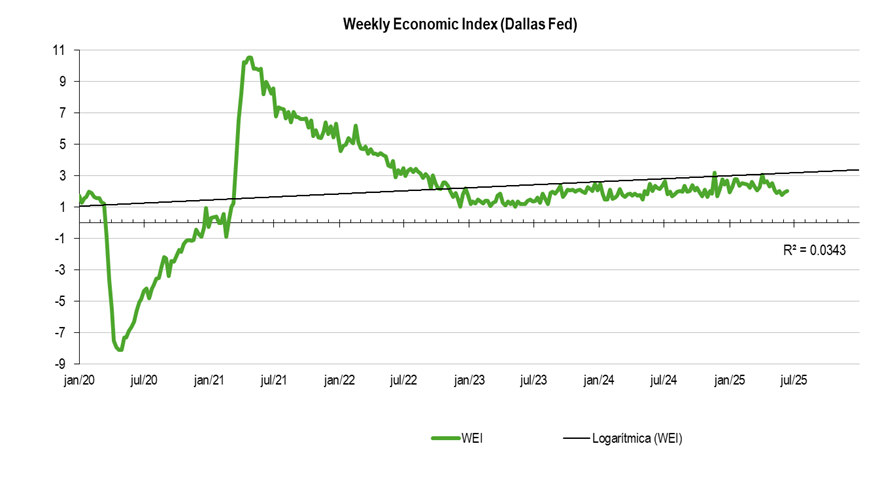

1 – The US economy remains surprisingly resilient. Two monthly Fed surveys about the US economy, that we usually follow, were released last week, “Empire Sate Manufacturing”, NY Federal Reserve Bank and “Manufacturing Business Outlook Survey”, Philadelphia Federal Reserve Bank. Both recorded expansion in July, the Phila Fed Current Conditions went up from -4 in June to +15 in July, while the NY Empire State Manufacturing Current conditions +5.5 vs. -16, in the prior month, the “Future Business Activity” remain positive in both indices. The Weekly Economic Index Dallas Fed, that provides a signal of the state of the US economy, has recently smoothly increased, to levels slightly above 2%YoY and 2Q25 average data around 2.26%, just slightly lower than 1Q25.

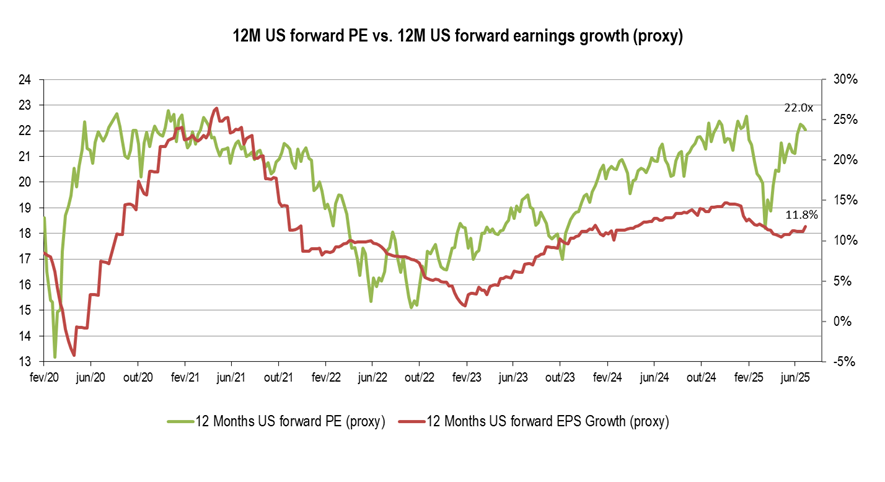

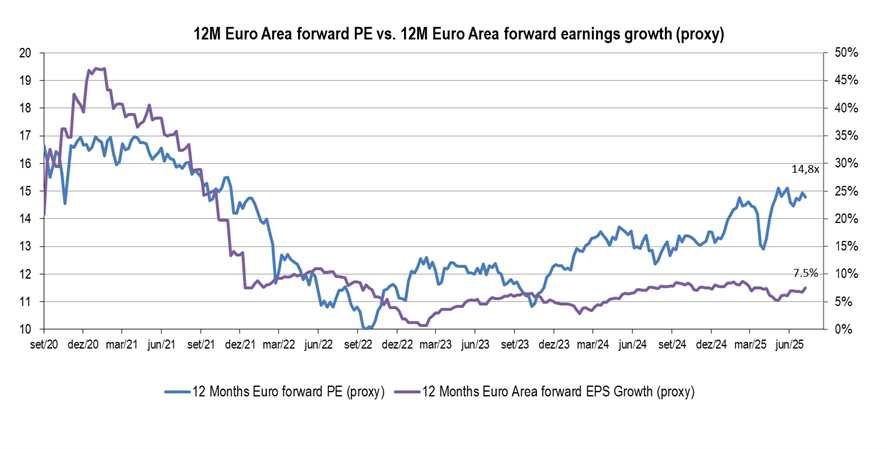

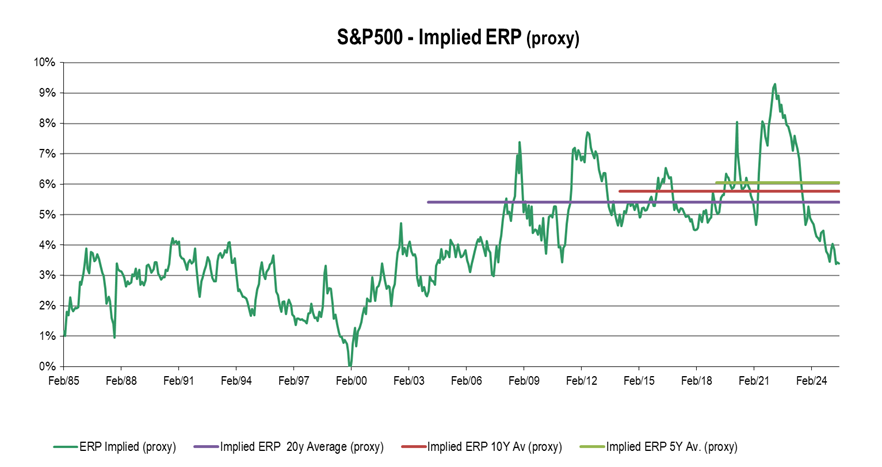

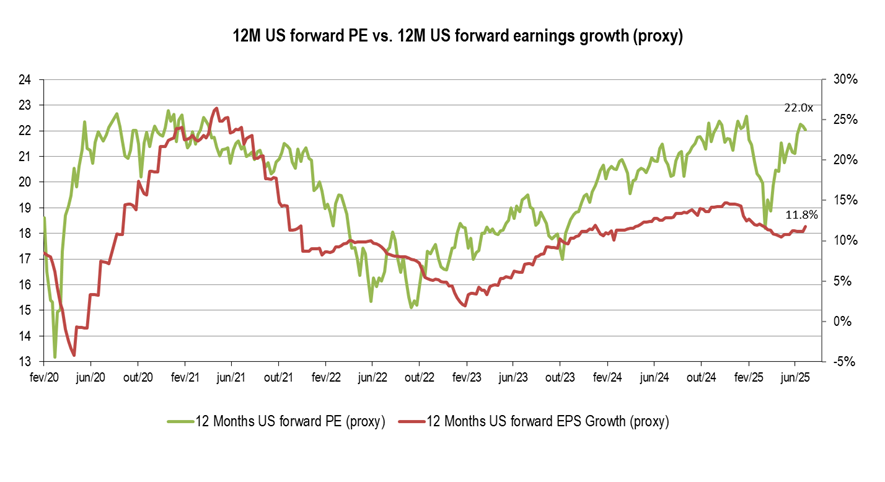

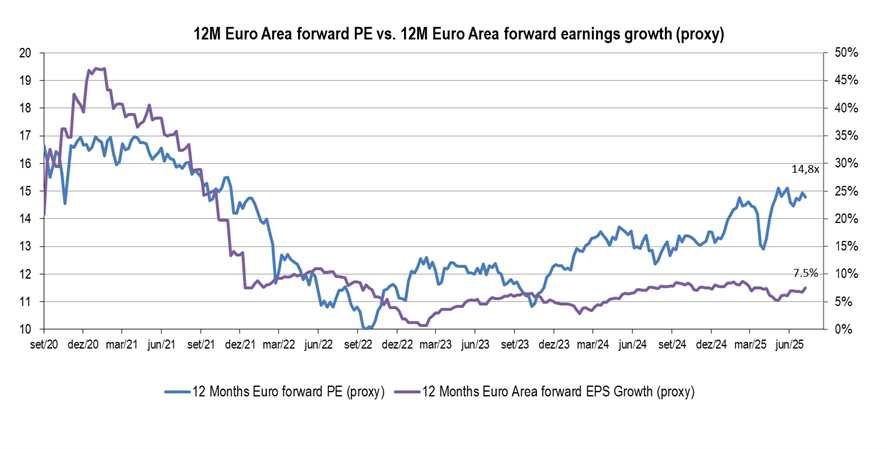

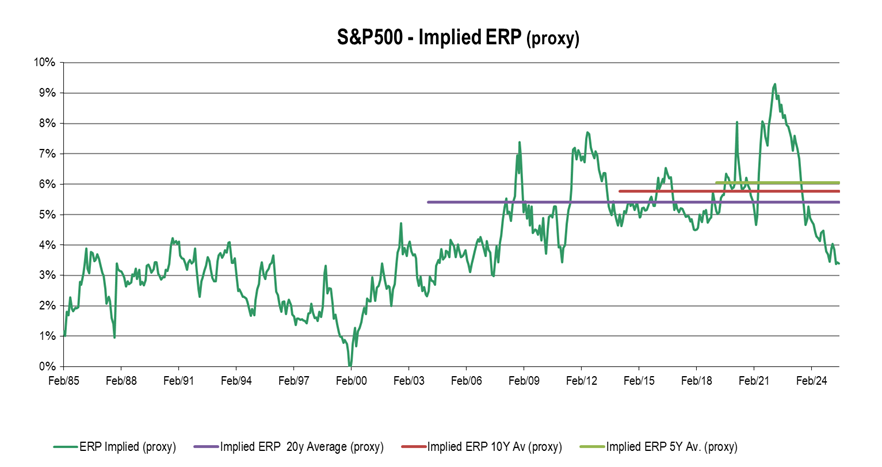

2 – Valuations remain under pressure, US forward PE, around 22x and Euro Area around 15x. Both above short and long-term averages. A similar, conclusion regarding the Equity Risk Premium (ERP), a measure that takes in consideration, apart from earnings, interest rates and inflation, current figures below short and long-term averages. Nevertheless, the earnings momentum, namely forward growth, has improved recently. It’s partially a mechanical effect, from the fact that earnings in 2026 have a higher growth rate than in 2025, so the time-weighted average will continue to increase forward growth, as the year goes on, ceteris paribus.

All in all, the US economy has gained momentum recently, despite the uncertainty triggered by the US Administration, remaining surprisingly strong. Meanwhile, forward earnings continue to be reviewed upwards, partially explained by the mechanical effect, as 2026 earnings consensus are higher than 2025, so as the year goes on, forward growth, as usual, increases, ceteris paribus. Finally, valuations remain inappropriate for “Value Investors”, however assuming that over the coming weeks/months more Tariffs Agreements will be settled, the positive environment to equities should remain in place, so Multiples should continue to expand.

Disclaimer

1 – The US economy remains surprisingly resilient. Two monthly Fed surveys about the US economy, that we usually follow, were released last week, “Empire Sate Manufacturing”, NY Federal Reserve Bank and “Manufacturing Business Outlook Survey”, Philadelphia Federal Reserve Bank. Both recorded expansion in July, the Phila Fed Current Conditions went up from -4 in June to +15 in July, while the NY Empire State Manufacturing Current conditions +5.5 vs. -16, in the prior month, the “Future Business Activity” remain positive in both indices. The Weekly Economic Index Dallas Fed, that provides a signal of the state of the US economy, has recently smoothly increased, to levels slightly above 2%YoY and 2Q25 average data around 2.26%, just slightly lower than 1Q25.

US – Manufacturing Business Outlook Survey (NY Fed)

Source: Business Leaders Survey, New York Fed (Federal Reserve Bank of New York)

US – Manufacturing Business Outlook Survey (Philadelphia Fed)

Source: Federal Reserve Bank of Philadelphia (Manuf. Business Outlook Survey)

US –Weekly Economic Index (Dallas Fed)

Source: Federal Reserve Bank of Dallas, AS Ind. Research

2 – Valuations remain under pressure, US forward PE, around 22x and Euro Area around 15x. Both above short and long-term averages. A similar, conclusion regarding the Equity Risk Premium (ERP), a measure that takes in consideration, apart from earnings, interest rates and inflation, current figures below short and long-term averages. Nevertheless, the earnings momentum, namely forward growth, has improved recently. It’s partially a mechanical effect, from the fact that earnings in 2026 have a higher growth rate than in 2025, so the time-weighted average will continue to increase forward growth, as the year goes on, ceteris paribus.

Forward PE* vs. Forward Earnings Growth (proxy)

* Forward Multiple – Basically the current index value divided by the 12 months forward earnings consensus (proxy). Historically, lower figures, namely below average, could indicate the stock market is undervalued and vice-versa. It’s easy to calculate, straightforward, however it does not take in consideration the level of interest rates

Source: Consensus, AS Ind. Research

Source: Consensus, AS Ind. Research

Implied Equity Risk Premium (proxy)*

* ERP – the implied equity risk premium is our preferred measure to value the equity market. Basically, is a Dividend Discount Model, based on several premises that we keep over time. The historical data allows us to have a quantitative opinion regarding the equity market. The ingredients are, earnings consensus proxy, interest rates, 10-year government bonds and finally, inflation data, namely core data. Higher figures vs. historical data indicates the stock market could be undervalued and vice-versa.

Source: Consensus, AS Ind. Research

Source: Consensus, AS Ind. Research

All in all, the US economy has gained momentum recently, despite the uncertainty triggered by the US Administration, remaining surprisingly strong. Meanwhile, forward earnings continue to be reviewed upwards, partially explained by the mechanical effect, as 2026 earnings consensus are higher than 2025, so as the year goes on, forward growth, as usual, increases, ceteris paribus. Finally, valuations remain inappropriate for “Value Investors”, however assuming that over the coming weeks/months more Tariffs Agreements will be settled, the positive environment to equities should remain in place, so Multiples should continue to expand.

Disclaimer

This information is merely an auxiliary means of analysis to be used by its recipients, who will be solely responsible for its use, including for any losses or damage that may, directly or indirectly, derive from. The data herein disclosed are merely indicative and reflect the market conditions prevailing on the date they were collected. Thus, its accuracy and timing must absolutely be confirmed before its usage. Any alteration in the market conditions shall imply the introduction of changes in this report. This information/this opinion may be altered without prior notice and may differ or be contrary to opinions expressed, because of using different assumptions and criteria. The analysis contained herein is based on numerous assumptions. Different assumptions could result in materially different results. This information is not an offer to sell or a solicitation to enter any deal or contract. It consists of data compiled by or of opinions or estimates from AS Independent Research and no representation or warranty is made as to its accuracy or completeness. Reproduction is not allowed without AS Independent Research permission.

This blog post is for informational purposes only. The information contained in this blog post is not legal, tax, or investment advice. 3Comma Capital does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.

This blog post is for informational purposes only. The information contained in this blog post is not legal, tax, or investment advice. 3Comma Capital does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.

|

António Seladas, CFA

3 Comma Capital Blog Contributor

|

This post was written in collaboration with António Seladas, CFA. António founded AS Independent Research and provides expert research to clients.