Market Watch

Snapshot of the Portuguese Economy (July)

Snapshot

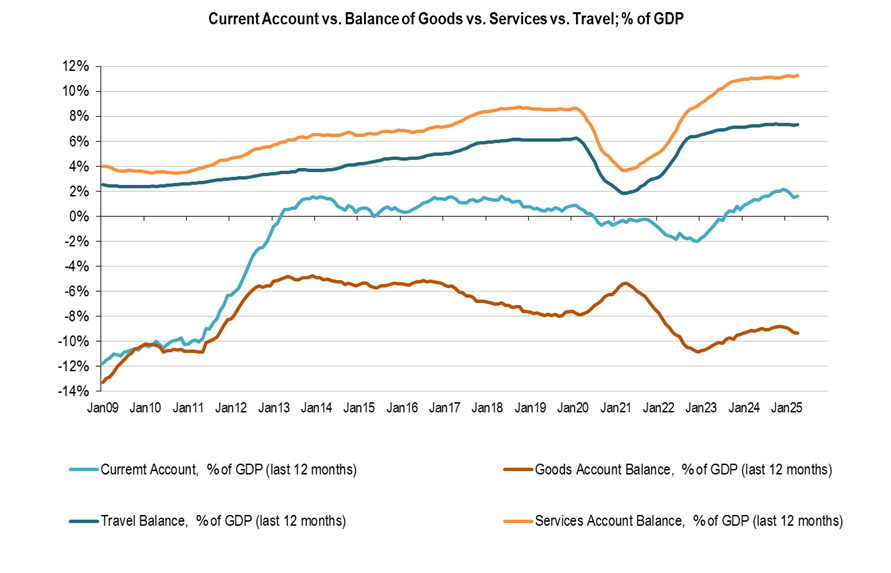

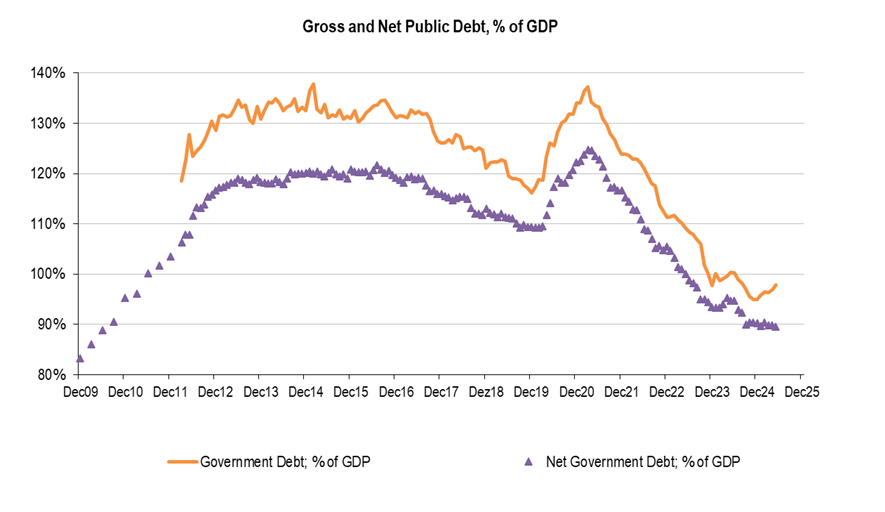

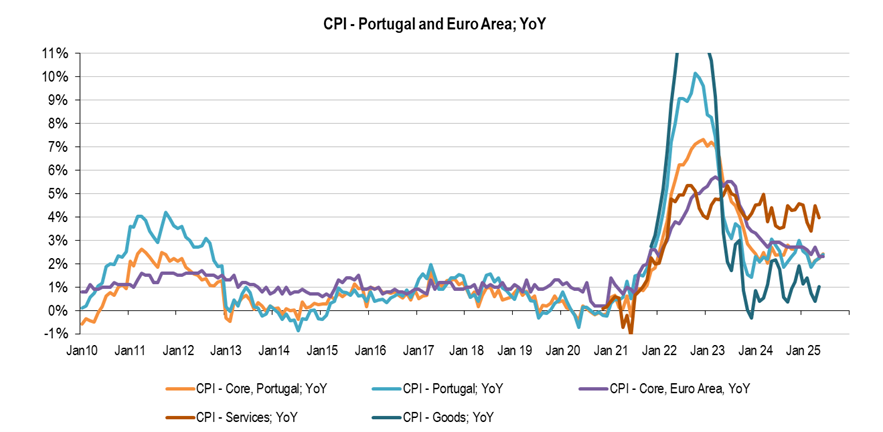

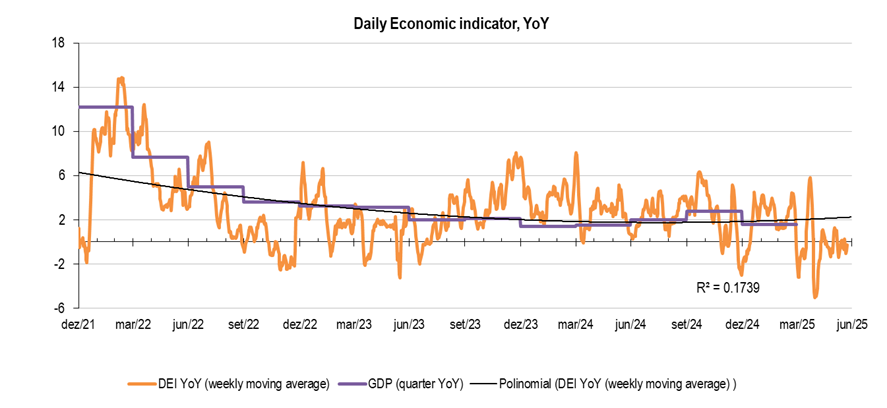

The portuguese economy remains probably healthy than ever; the best gauge is the spread between the 10y German Bunds and Portuguese 10y OT (public debt) slightly below 50bp and roughly 18bp lower than the Spanish “Bonos del Estado”. The job market is strong, employed population at record levels, salaries are growing above inflation, while inflation remains below 2.5%; fiscal execution points to balance figures, public debt slightly below 100% of GDP and positive Current Account Balance. Meanwhile, GDP underperformed over the 1Q25, +1.6%YoY, while current data, regarding the 2Q25, performance is ambiguous. Finally, on the negative side, Goods balance deficit above 9% of GDP, is becoming structural, more than offset by a positive Services balance, mainly based on Tourism strong performance over the last 10/15 years, while balanced public figures derive mainly from higher tax revenues and Contributions than lower Expenditures, which could be a problem in a weaker economy.Job market

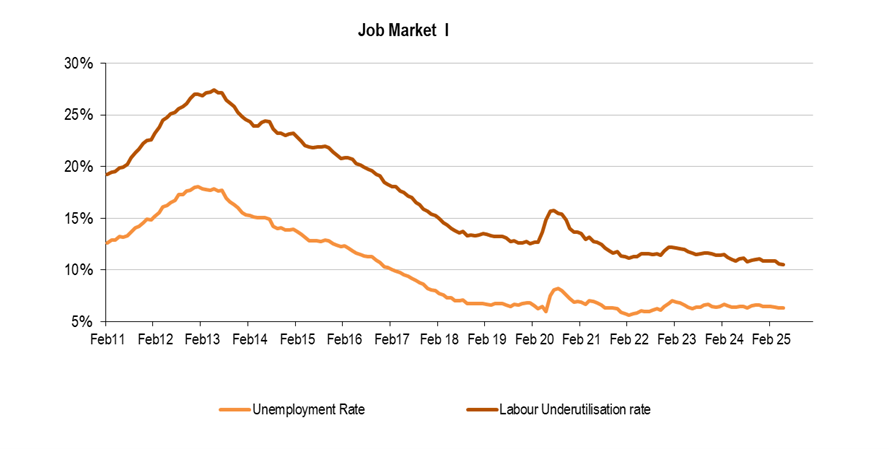

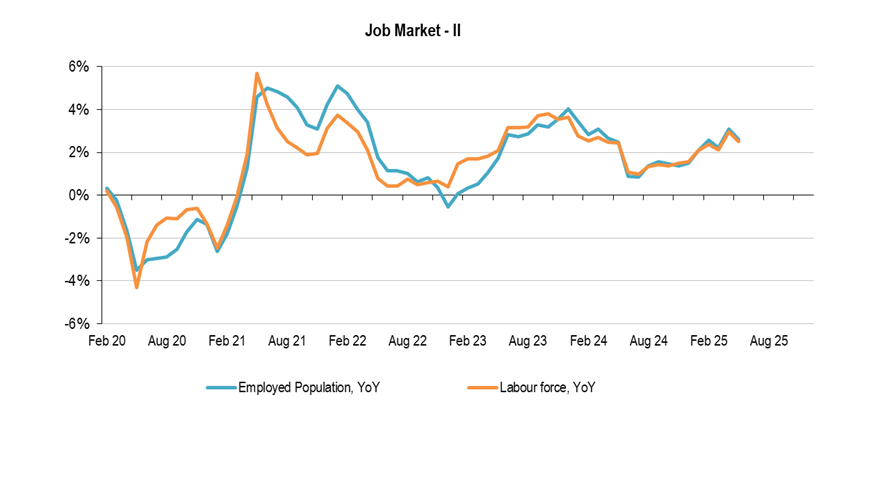

Unemployment Rate (monthly data): the job market stabilized in May at record levels. Active population (5 554 900) and Employed population (5 206 000) keep growing in tandem, close to 2.5%YoY; so, stabilizing the unemployed people close to 350 000; the unemployment rate at 6.3% and Underutilization rate (takes in consideration the under-utilization population divided by a broad concept of Active population) at 10.5% (please see graphs below).

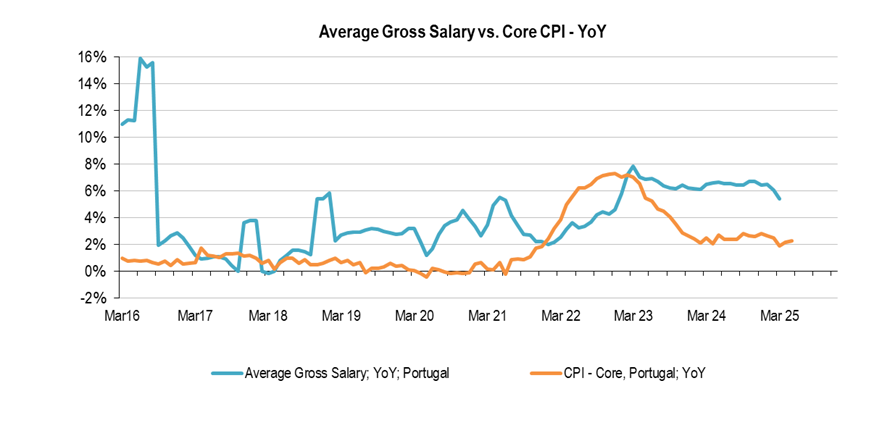

Average Salary (quarterly data): average gross salaries are growing slightly above 5% (last data released March 2025; 5.2%YoY), showing a small adjustment vs. figures between 6.1% and 6.7%; over 2024. Nevertheless, remain well above core CPI, feeding consumption/economic activity.

Source: INE, AS Independent Research

External Data

The Current Account Balance improved in April, mainly due to Easter effect. Surplus in April, last 12 months, 1.6% of GDP; o/w Goods Balance deficit 9.3% of GDP (last 12 months) and surplus at Services, 11.3% of GDP. In fact, Services Balance surplus in April went up 19.1%YoY above moving averages, partially explained by Travel surplus, 8.7%YoY and Transports Services: 26%YoY, both improved due to Easter.In a nutshell, external figures remain positive mainly due to Services Balance, that runs a Surplus slightly above 11% of GDP (Travel, included on Services Balance, surplus 7.3% of GDP), while the Goods balance runs a structural deficit, that is stabilizing slightly above 9% of GDP. Finally, Primary Income (mainly dividends and interests paid to non-residents) runs a deficit slightly below 2% of GDP, while secondary Income (mainly remittances from emigrants) runs a surplus close to 1.5%; almost offset each other.

Source: INE, AS Independent Research

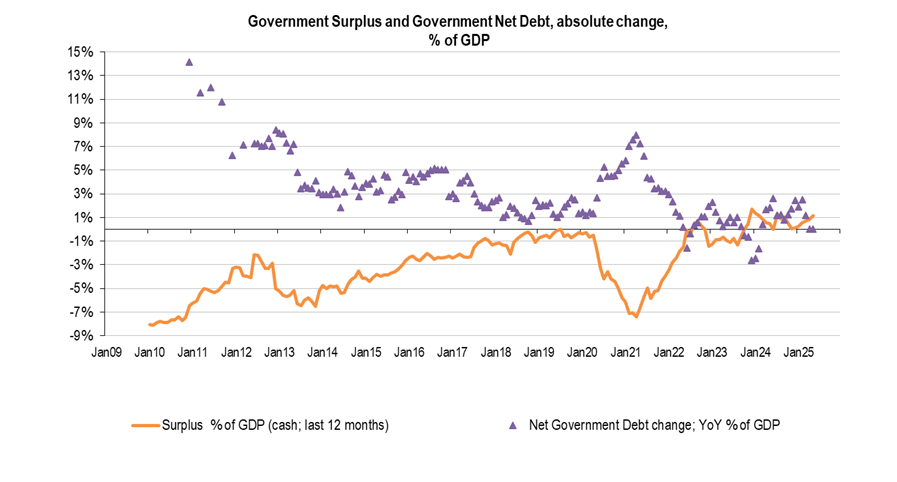

Fiscal Execution and Public Debt

The budget execution, in May, kept surprising, surplus +€597MnYtD vs. a deficit of €2.5Bn in 2024 (until May), mainly due to lower IRS reimbursements (IRS revenues +17.8%YtD), higher IRC (tax profit), revenues (+38.7%YtD), Indirect taxes (+9.3%YtD) and Expenditures under control, +4.5%YtD (mainly a high base effect). Unfortunately, Debt vs. Budget execution keeps underperforming, the Budget surplus €597MnYtD is not aligned with Debt increase, net of deposits, +€2.86BnYtD.

Source: INE, BoP, AS Independent Research

Inflation

Inflation in Portugal is running between 2% and 2.5%; aligned with the Euro Area inflation, namely core data (excludes volatile items like fresh food and energy, to reveal the underlying trend). Meanwhile, Services inflation, around 4%YoY continues to push upwards the general trend, while Goods inflation around 1%, partially offset it. The strong job market and salaries growing above inflation continues to pressure Services inflation.

Economic Activity

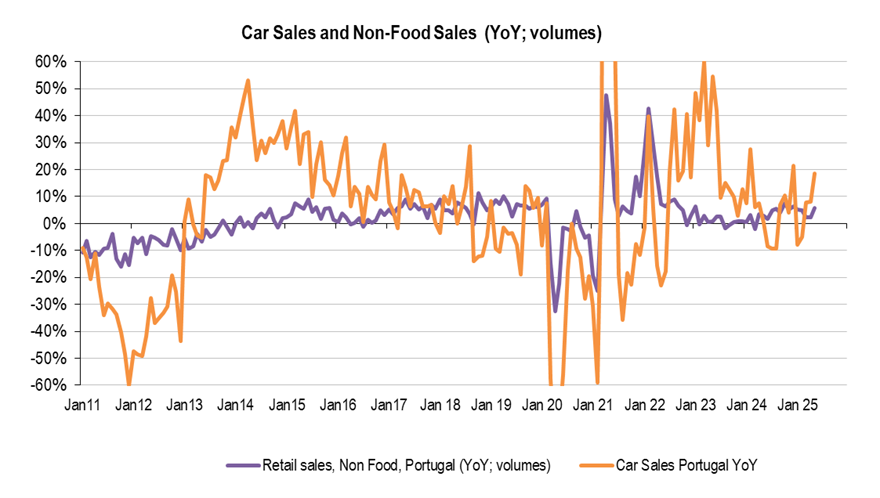

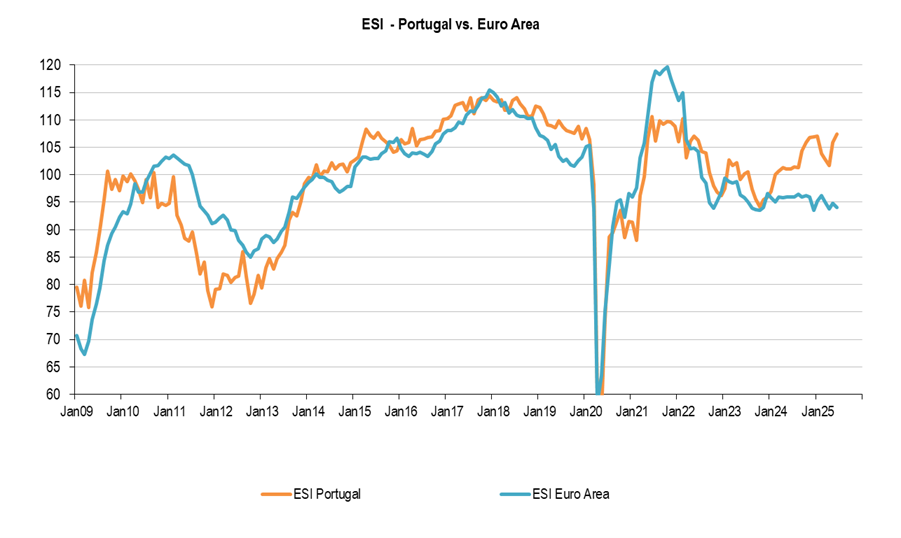

In general data has been ambiguous, the Daily Economic Index, a weekly data provided by the Bank of Portugal (BoP), but not official (“based on high-frequency data and makes it possible to capture changes in economic activity in a timely manner”) has underperformed over the quarter, average data slightly negative, on an yearly basis. Meanwhile, retail sales data (April and May) remained robust and soft data like ESI (Economic Sentiment Indicator, a composite index that reflects the overall economic confidence of businesses and consumers), is also outperforming.

Source: INE, BoP, European Commission, AS Independent Research

Disclaimer

This information is merely an auxiliary means of analysis to be used by its recipients, who will be solely responsible for its use, including for any losses or damage that may, directly or indirectly, derive from. The data herein disclosed are merely indicative and reflect the market conditions prevailing on the date they were collected. Thus, its accuracy and timing must absolutely be confirmed before its usage. Any alteration in the market conditions shall imply the introduction of changes in this report. This information/this opinion may be altered without prior notice and may differ or be contrary to opinions expressed, because of using different assumptions and criteria. The analysis contained herein is based on numerous assumptions. Different assumptions could result in materially different results. This information is not an offer to sell or a solicitation to enter any deal or contract. It consists of data compiled by or of opinions or estimates from AS Independent Research and no representation or warranty is made as to its accuracy or completeness. Reproduction is not allowed without AS Independent Research permission.

This blog post is for informational purposes only. The information contained in this blog post is not legal, tax, or investment advice. 3Comma Capital does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.

This blog post is for informational purposes only. The information contained in this blog post is not legal, tax, or investment advice. 3Comma Capital does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.

|

António Seladas, CFA

3 Comma Capital Blog Contributor

|

This post was written in collaboration with António Seladas, CFA. António founded AS Independent Research and provides expert research to clients.