Golden Visa

Portugal’s Economy: Resilient Growth, Stable Inflation, and Outperformance in the Euro Area

The Bank of Portugal’s October 2025 Economic Bulletin presents a broadly positive outlook for the Portuguese economy over the 2025–2027 period. Despite a complex global backdrop marked by geopolitical tensions, rising trade barriers, and persistent external uncertainty, Portugal is set to remain one of the Euro Area’s top performers in terms of growth, inflation control, and labour market resilience.

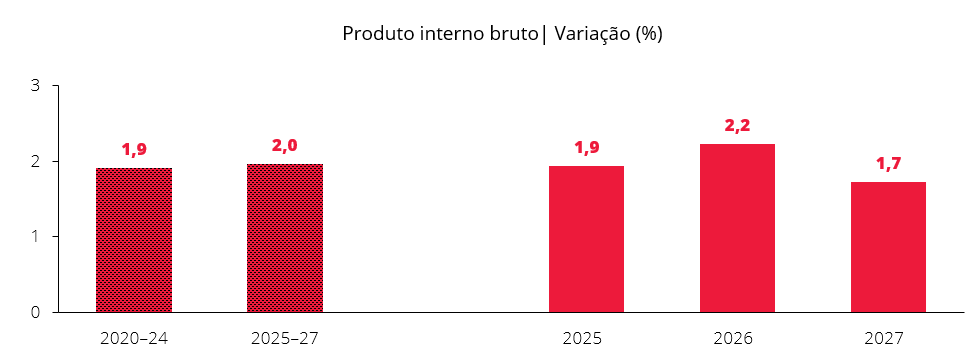

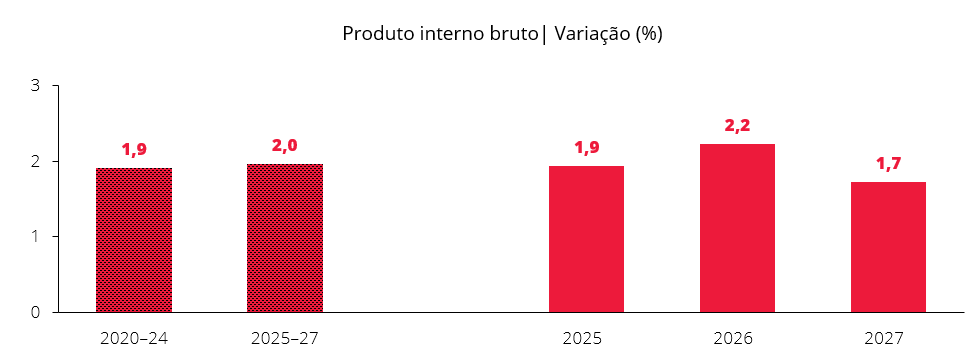

Source: Banco de Portugal | GDP Annual Growth Projection

This expansion is expected to be driven primarily by domestic demand, supported by a robust labour market, accommodative monetary policy, and historically high EU structural funds. Net EU transfers are forecast to reach 2.1% and 2.9% of GDP in 2025 and 2026, respectively, reflecting the continued execution of projects under the Recovery and Resilience Plan (PRR). Fiscal policy will also play a significant role, with new tax reductions and social measures set to boost household disposable income and private consumption.

Investment is forecast to follow a differentiated path across components. While public investment is expected to accelerate significantly in 2025–26 before declining in 2027, housing investment will remain solid - expanding by 3.4% on average per year - supported by lower interest rates, robust demand, and government incentives for first-time buyers. Business investment, on the other hand, is likely to slow temporarily in 2025 (-1.4%) due to elevated uncertainty but is projected to rebound in 2026–27.

Export growth will moderate to 2.0% annually (compared to 4.6% in the previous decade), reflecting weaker external demand and the impact of rising trade tariffs, while the services sector - now accounting for roughly three-quarters of economic activity - will continue to underpin structural growth.

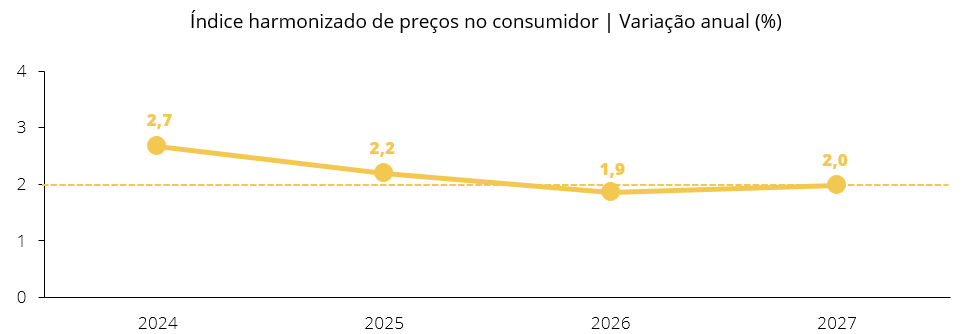

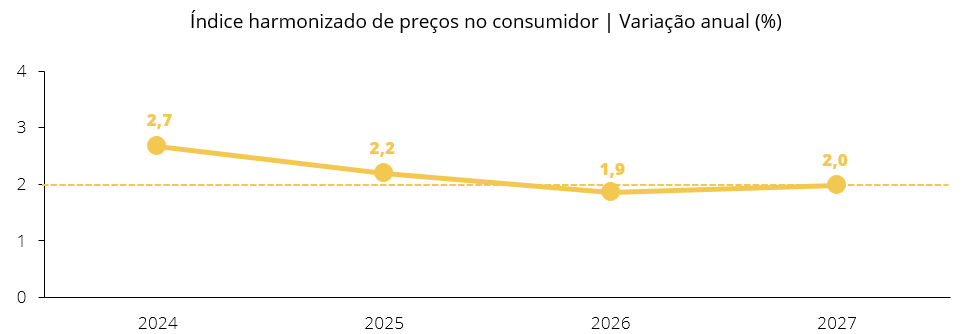

Source: Banco de Portugal | Inflation Annual Projection

Core inflation - excluding energy, food, and volatile tourism-related components - is expected to remain stable around 2.3%–2.4% in 2025, reflecting the gradual easing of domestic cost pressures, including wage growth. After an average increase of 8.4% in 2023–24, wages are forecast to grow by 5.1% in 2025 and moderate further to 4.1% in 2026 and 3.8% in 2027, broadly aligning real wage growth with productivity gains.

External factors, including lower energy prices, a stronger euro, and declining import costs, are also expected to support a stable price environment. Inflation expectations remain well anchored, and the ECB’s new monetary policy framework - which explicitly recognises a potentially more volatile inflation environment - reinforces the medium-term orientation of policy decisions.

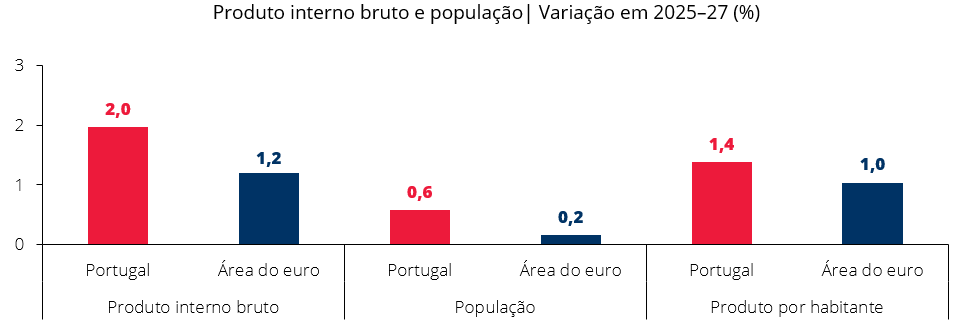

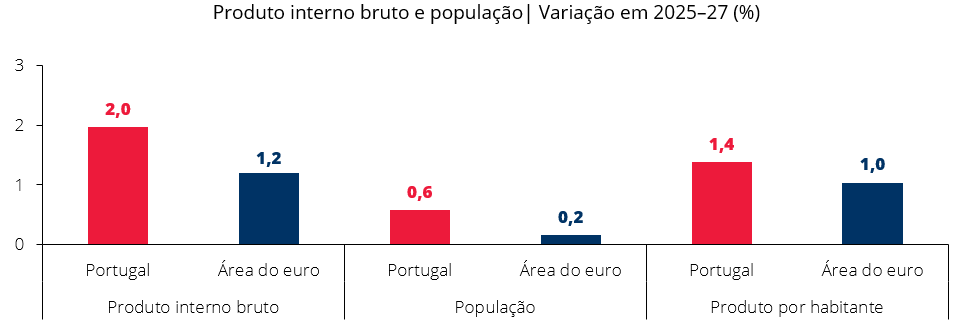

Source: Banco de Portugal | Portugal GDP, Population & GDP per Capital vs Eurozone

When adjusted for demographic dynamics and employment trends, Portugal’s growth advantage remains significant - around 0.4 percentage points - underscoring stronger productivity gains relative to its European peers. Labour market fundamentals are also supportive: employment is projected to expand by 1.8% in 2025, with the unemployment rate stabilising at a historically low 6.3%.

Structural shifts in the economy further underpin Portugal’s resilience. The continued expansion of the services sector - traditionally less volatile than industry - has enhanced the economy’s capacity to absorb external shocks. In parallel, Portuguese companies have made notable competitiveness gains in high-tech, knowledge-intensive sectors, improving the country’s export mix and positioning in global value chains.

In a global environment marked by uncertainty and shifting trade dynamics, Portugal’s stable macroeconomic outlook, combining sustainable growth with price stability, positions it as one of the Euro Area’s most resilient economies in the years ahead.

Solid Growth Outlook Driven by Domestic Demand

Portugal’s GDP is projected to expand by 1.9% in 2025, accelerate to 2.2% in 2026, and moderate to 1.7% in 2027, resulting in an average annual growth rate of 2.0% over the forecast horizon - broadly in line with the country’s performance between 2020 and 2024.

Source: Banco de Portugal | GDP Annual Growth Projection

This expansion is expected to be driven primarily by domestic demand, supported by a robust labour market, accommodative monetary policy, and historically high EU structural funds. Net EU transfers are forecast to reach 2.1% and 2.9% of GDP in 2025 and 2026, respectively, reflecting the continued execution of projects under the Recovery and Resilience Plan (PRR). Fiscal policy will also play a significant role, with new tax reductions and social measures set to boost household disposable income and private consumption.

Investment is forecast to follow a differentiated path across components. While public investment is expected to accelerate significantly in 2025–26 before declining in 2027, housing investment will remain solid - expanding by 3.4% on average per year - supported by lower interest rates, robust demand, and government incentives for first-time buyers. Business investment, on the other hand, is likely to slow temporarily in 2025 (-1.4%) due to elevated uncertainty but is projected to rebound in 2026–27.

Export growth will moderate to 2.0% annually (compared to 4.6% in the previous decade), reflecting weaker external demand and the impact of rising trade tariffs, while the services sector - now accounting for roughly three-quarters of economic activity - will continue to underpin structural growth.

Inflation Anchored Near ECB Target

Inflation dynamics are expected to stabilise, with headline inflation converging towards the European Central Bank’s (ECB) 2% price stability target. The Harmonised Index of Consumer Prices (HICP) is projected to average 2.2% in 2025, 1.9% in 2026, and 2.0% in 2027, marking the successful conclusion of a disinflationary cycle that began in 2023.

Source: Banco de Portugal | Inflation Annual Projection

Core inflation - excluding energy, food, and volatile tourism-related components - is expected to remain stable around 2.3%–2.4% in 2025, reflecting the gradual easing of domestic cost pressures, including wage growth. After an average increase of 8.4% in 2023–24, wages are forecast to grow by 5.1% in 2025 and moderate further to 4.1% in 2026 and 3.8% in 2027, broadly aligning real wage growth with productivity gains.

External factors, including lower energy prices, a stronger euro, and declining import costs, are also expected to support a stable price environment. Inflation expectations remain well anchored, and the ECB’s new monetary policy framework - which explicitly recognises a potentially more volatile inflation environment - reinforces the medium-term orientation of policy decisions.

Outperforming the Euro Area

Portugal’s economic performance is expected to continue outpacing the Euro Area average over the next three years. The Bank of Portugal forecasts that GDP growth will exceed the Euro Area average by 0.8 percentage points annually between 2025 and 2027, broadly in line with the 0.7 percentage-point differential recorded between 2020 and 2024.

Source: Banco de Portugal | Portugal GDP, Population & GDP per Capital vs Eurozone

When adjusted for demographic dynamics and employment trends, Portugal’s growth advantage remains significant - around 0.4 percentage points - underscoring stronger productivity gains relative to its European peers. Labour market fundamentals are also supportive: employment is projected to expand by 1.8% in 2025, with the unemployment rate stabilising at a historically low 6.3%.

Structural shifts in the economy further underpin Portugal’s resilience. The continued expansion of the services sector - traditionally less volatile than industry - has enhanced the economy’s capacity to absorb external shocks. In parallel, Portuguese companies have made notable competitiveness gains in high-tech, knowledge-intensive sectors, improving the country’s export mix and positioning in global value chains.

Conclusion

The Bank of Portugal’s latest projections confirm that Portugal’s economy remains structurally stronger and more resilient than in previous cycles. Growth will be anchored by robust domestic demand, fiscal support, and EU funding, while inflation converges toward the ECB’s target and the labour market remains tight. Importantly, Portugal is expected to continue outperforming the broader Euro Area, driven by productivity growth, services-sector expansion, and improved export competitiveness.In a global environment marked by uncertainty and shifting trade dynamics, Portugal’s stable macroeconomic outlook, combining sustainable growth with price stability, positions it as one of the Euro Area’s most resilient economies in the years ahead.

|

Duarte Caldas

Investments Principal

|

With more than 20 years of experience in financial markets, Duarte specialized in the energy area in the last decade, where he had the opportunity to work with the main European Power and Gas institutions at CIMD Group. Previously, he worked as Market Strategist at IG Markets Iberia.