Market Watch

Demand for Spot Bitcoin ETFs Hits an All-Time High

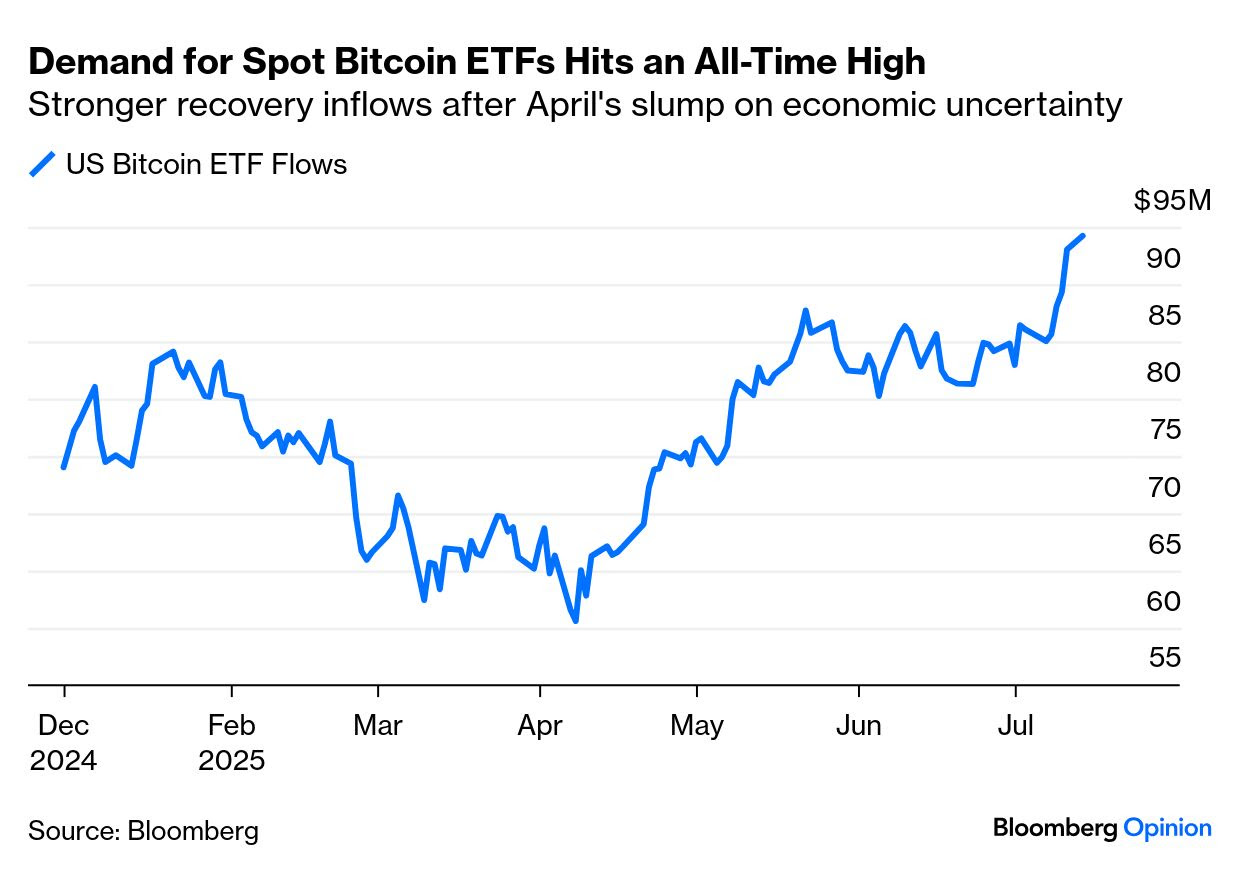

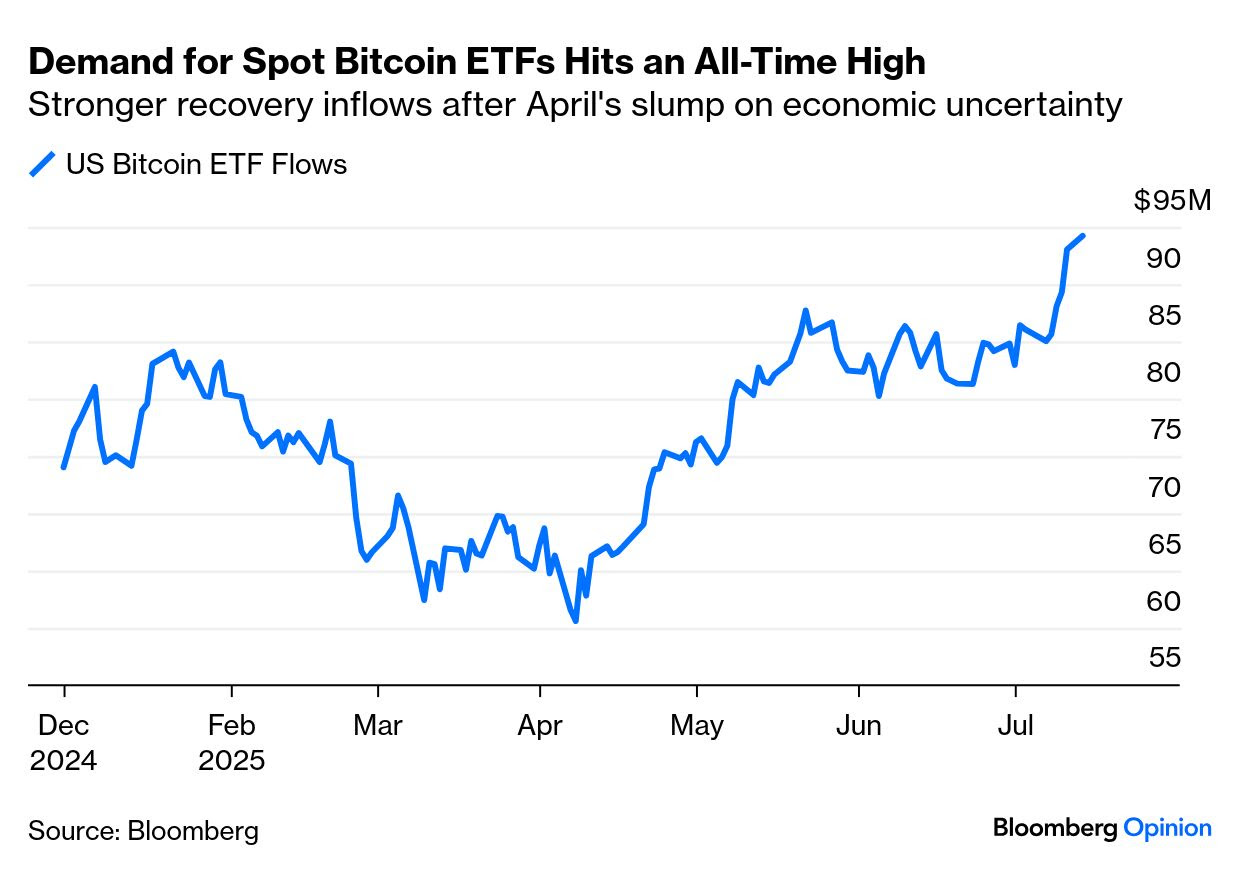

Bitcoin has entered a new phase of price discovery. In a decisive move last week, the world's largest digital asset shattered the upper bound of its "10 week" - $100,000 to $110,000 trading range, surging to a new all-time high of $123,120. This represents a remarkable 65% rebound from its April lows. Critically, this breakout is not a speculative echo of past cycles, it is fundamentally anchored in a powerful confluence of unprecedented spot ETF demand, renewed corporate treasury interest, and deepening institutional conviction.

To put the velocity of this adoption into perspective, cumulative inflows into digital asset investment products have now reached $15.2 billion since the Federal Reserve’s first interest rate cut in September 2024. Year-to-date inflows for 2025 have already set a new annual record at $37 billion. This figure dwarfs the mere $309 million in net inflows seen during the first full year of U.S. gold ETF trading in 2004, illustrating the accelerated pace of Bitcoin's monetization.

This accumulation by new entrants is creating a robust demand floor. Analysis of investor cohorts shows that while long-term holders have moderated their profit-taking, short-term holders are now absorbing supply with conviction. This dynamic suggests a healthy transfer of assets to new, committed buyers, fostering a more sustainable foundation for this bull phase.

This leadership role is being supported by an increasingly favorable macroeconomic backdrop. Following a long pause, recent commentary from the Federal Reserve has signaled a more dovish policy stance. In an environment of persistent inflation and rising sovereign debt concerns, Bitcoin’s core value proposition as a decentralized, non-sovereign store of value is gaining significant traction. Furthermore, the recent Federal Reserve’s FOMC meeting introduced proposals to ease the Supplementary Leverage Ratio (SLR) requirements, signaling a growing alignment between monetary policy and the Trump administration’s broader economic agenda. These proposed SLR revisions represent a significant, yet currently underappreciated shift towards credit expansion primarily via commercial banks, diverging from direct intervention through the Fed’s balance sheet, commonly known as Quantitative Easing.

By easing capital constraints on U.S. globally systemically important banks, these changes could potentially unlock more than $200 billion in additional lending capacity, thereby effectively injecting substantial liquidity into the financial system. While markets have yet to price in the comprehensive implications of this move fully, its broader impact is potentially far-reaching: additional available liquidity typically tends to support risk assets, apply downward pressure on the U.S. dollar, and subtly but meaningfully signal an increase in political influence over the central bank's policy direction.

The message for investors is clear: Bitcoin's transition from a peripheral asset to a core portfolio component is accelerating. The maturation of regulated, transparent, and liquid investment vehicles like spot ETFs has removed major barriers to entry, enabling the broad-based institutional participation we are now witnessing. Global liquidity indicators are often robust precursors to bullish trends, and Bitcoin, in particular, tends to exhibit an accentuated response during periods of rapid liquidity expansion, frequently rallying significantly.

At 3 Comma Capital, we believe this is not just an expansion of access but a fundamental reshaping of modern portfolio construction, validating Bitcoin's role as an essential hedge and a powerful driver of returns in an increasingly uncertain world.

► Explore the 3CC Global Crypto Fund, a regulated investment vehicle managed by 3 Comma Capital. The fund provides diversified exposure to leading digital, with an active management approach and robust risk controls.

To learn more about how digital assets can complement a diversified portfolio, visit www.3commacapital.com or reach out to our team.

The ETF Juggernaut: A Structural Shift in Demand

The primary catalyst for this rally is the relentless demand for U.S.-based spot Bitcoin ETFs, which posted their strongest week on record, absorbing over $3.1 billion in net inflows. This institutional-grade demand is reshaping the market's structure. BlackRock’s iShares Bitcoin Trust (IBIT) exemplifies this trend, having now surpassed 700,000 BTC in assets under management. Its scale now rivals that of major commodity ETFs, cementing its role as a permanent and powerful force in the digital asset landscape.To put the velocity of this adoption into perspective, cumulative inflows into digital asset investment products have now reached $15.2 billion since the Federal Reserve’s first interest rate cut in September 2024. Year-to-date inflows for 2025 have already set a new annual record at $37 billion. This figure dwarfs the mere $309 million in net inflows seen during the first full year of U.S. gold ETF trading in 2004, illustrating the accelerated pace of Bitcoin's monetization.

A New Wave of Corporate and Institutional Adoption

The momentum from ETFs is being reinforced by strategic corporate and institutional accumulation. On-chain data from sources like Glassnode reveals a significant uptick in the number of "whale" addresses (wallets holding over 1,000 BTC), indicating that large, sophisticated entities are actively building positions. This trend is complemented by fresh corporate treasury allocations, with more than 150 public companies now holding Bitcoin on their corporate balance sheets.This accumulation by new entrants is creating a robust demand floor. Analysis of investor cohorts shows that while long-term holders have moderated their profit-taking, short-term holders are now absorbing supply with conviction. This dynamic suggests a healthy transfer of assets to new, committed buyers, fostering a more sustainable foundation for this bull phase.

Price Discovery in a Favorable Macro Climate

With key resistance levels at $109,000 and $112,000 now firmly established as support, Bitcoin is in a state of unambiguous price discovery. Technical analysis now projects a potential move toward the $125,000 to $136,000 range. The rally’s strength is particularly noteworthy, as it occurred without a breakout in equities which remain somewhat subdued amid tariff-related uncertainty and concerns over global growth.This leadership role is being supported by an increasingly favorable macroeconomic backdrop. Following a long pause, recent commentary from the Federal Reserve has signaled a more dovish policy stance. In an environment of persistent inflation and rising sovereign debt concerns, Bitcoin’s core value proposition as a decentralized, non-sovereign store of value is gaining significant traction. Furthermore, the recent Federal Reserve’s FOMC meeting introduced proposals to ease the Supplementary Leverage Ratio (SLR) requirements, signaling a growing alignment between monetary policy and the Trump administration’s broader economic agenda. These proposed SLR revisions represent a significant, yet currently underappreciated shift towards credit expansion primarily via commercial banks, diverging from direct intervention through the Fed’s balance sheet, commonly known as Quantitative Easing.

By easing capital constraints on U.S. globally systemically important banks, these changes could potentially unlock more than $200 billion in additional lending capacity, thereby effectively injecting substantial liquidity into the financial system. While markets have yet to price in the comprehensive implications of this move fully, its broader impact is potentially far-reaching: additional available liquidity typically tends to support risk assets, apply downward pressure on the U.S. dollar, and subtly but meaningfully signal an increase in political influence over the central bank's policy direction.

Market-Wide Impact and Investor Outlook

As is characteristic of Bitcoin-led rallies, a rising tide is lifting the entire digital asset market. Large-cap tokens posted widespread double-digit gains last week, and for the first time in months, there were no significant decliners among top-tier assets. Investor sentiment has shifted decisively toward bullish conviction, a fact reflected in the negligible $10 million of inflows into short-Bitcoin investment products - a clear indication that few are willing to bet against the current momentum.The message for investors is clear: Bitcoin's transition from a peripheral asset to a core portfolio component is accelerating. The maturation of regulated, transparent, and liquid investment vehicles like spot ETFs has removed major barriers to entry, enabling the broad-based institutional participation we are now witnessing. Global liquidity indicators are often robust precursors to bullish trends, and Bitcoin, in particular, tends to exhibit an accentuated response during periods of rapid liquidity expansion, frequently rallying significantly.

At 3 Comma Capital, we believe this is not just an expansion of access but a fundamental reshaping of modern portfolio construction, validating Bitcoin's role as an essential hedge and a powerful driver of returns in an increasingly uncertain world.

► Explore the 3CC Global Crypto Fund, a regulated investment vehicle managed by 3 Comma Capital. The fund provides diversified exposure to leading digital, with an active management approach and robust risk controls.

To learn more about how digital assets can complement a diversified portfolio, visit www.3commacapital.com or reach out to our team.

|

Duarte Caldas

Investments Principal

|

With more than 20 years of experience in financial markets, Duarte specialized in the energy area in the last decade, where he had the opportunity to work with the main European Power and Gas institutions at CIMD Group. Previously, he worked as Market Strategist at IG Markets Iberia.